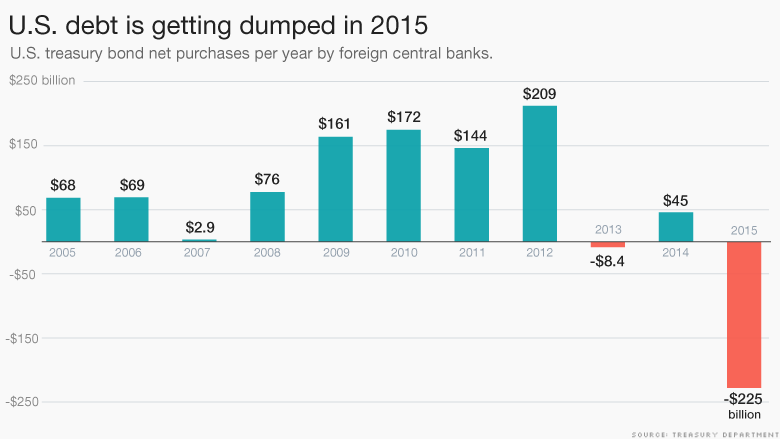

Foreign governments sold more U.S. Treasuries than they bought in 11 out of 12 months last year, according to Treasury data.

The U.S. debt dump is a sign of two things:

1. How aggressive central banks are acting to keep their economy afloat amid global weakness.

2. After years of building up savings -- the so-called "global savings glut" -- countries are starting to sell off their reserves.

A weak currency often reflects a slowing or shrinking economy. For instance, Russia and Brazil are both in recession and their currencies have collapsed in value.

Both these countries along with many developing countries depend on commodities like oil, metals and food, to power their growth. Commodity prices -- especially oil prices -- tanked last year and have continued to do so in 2016.

When commodities plunge, currencies tend to follow suit. And when currencies rapidly decline, cash tends to flow out of a country and into safer havens. So central banks have tried to prevent massive capital outflows by easing their currency collapse.

China spent $500 billion last year just to prop up its currency, the yuan.

Despite all its spending, China's total holdings -- by public institutions and private investors -- of U.S. Treasury debt is up a bit from a year ago.

That's also true for the majority of countries: total foreign holdings increased in December compared to a year ago.

So even though central banks are dumping U.S. debt, there's plenty of demand for it from private investors.

Reply With Quote

Reply With Quote

Connect With Us