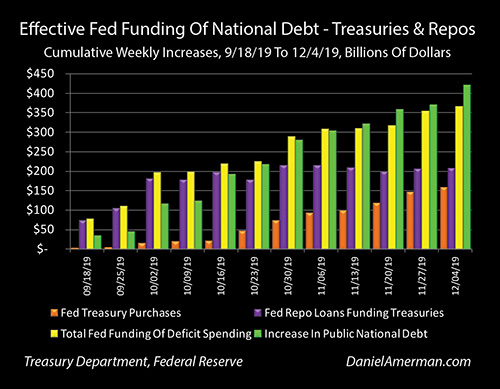

The Fed has printed $326 billion since September 11, 2019.

This amounts to a monthly increase of $108 billion. For comparison, QE3 at its height was 'only' $85 billion per month.

There are two components to this new QE: repo operations (essentially lending against collateral, like the ECB does) and outright asset purchases (like the Fed did during previous QE rounds). Three months ago, the repo market blew up, with interest rates spiking to extraordinary highs. What exactly caused this is still unknown, but it indicates severe stress in the financial system (i.e. someone couldn't pay their debts). The Fed responded first by offering short term repos, then longer term repos, then it restarted the asset purchase program, promising to buy $60 billion per month through at least March 2020. Of course, this is in addition to the Fed lowering the funds rate several times last year, after they realized that this economy will implode if rates return to even a small fraction of what was once considered normal.

Had the Fed not taken these actions, we'd likely be a recession right now.

If they don't ease further in the near future, it's likely that we'll soon be in a recession.

What's really worrying, however, is not so much a recession, as the prospect of the Fed easing in perpetuity to prevent one.

Reply With Quote

Reply With Quote

Connect With Us