Original Sin is the belief that sin, with all its accompanying miseries, entered human history in the Garden of Eden. When addressing the story that reporters for the anti-Trump

New York Times were leaked to, and these reporters subsequently released 10 years of supposedly confidential federal income tax returns of the president, from more than 20 years

before Donald Trump was even elected, one should note the “original sin” of this story.

It is the passage of the 16

th Amendment in 1913, which authorized Congress to enact a federal income tax. While all but anarchists understand that government, at all levels, needs some source of revenue to exercise its legitimate powers, the federal income tax has played a huge role in increasing the power of that federal government at the expense of the state governments. That is because the feds, with this large source of revenue obtained via a federal tax on the incomes of its citizens, can essentially bully states into adopting its policies by threatening to “withhold federal funds.”

And with the Internal Revenue Service (IRS) charged with collecting these taxes, a huge door has been opened for the federal government to intrude on the privacy of millions of its own citizens. With the draconian penalties associated with the enforcement of federal income tax laws, the IRS can be used as a potent weapon in the political arena.

In the past, this political use of the IRS has been by presidents and their allies against the political opposition. Now, with the Deep State’s usurpation of the authority of the duly-elected president of the United States, the IRS is actually being used against President Trump.

These opponents of Trump — in the media and within the Democratic Party — have been calling for a release of Trump’s tax returns since even before his 2016 election. During the campaign, the media and the Democrats (largely the same thing) argued that it is an established precedent that presidential candidates release several years of income tax returns. It should be noted that it is not a law for candidates to release any of their legally confidential tax returns.

Certainly, no candidate before Trump has ever been expected to release tax returns going back more than 30 years.

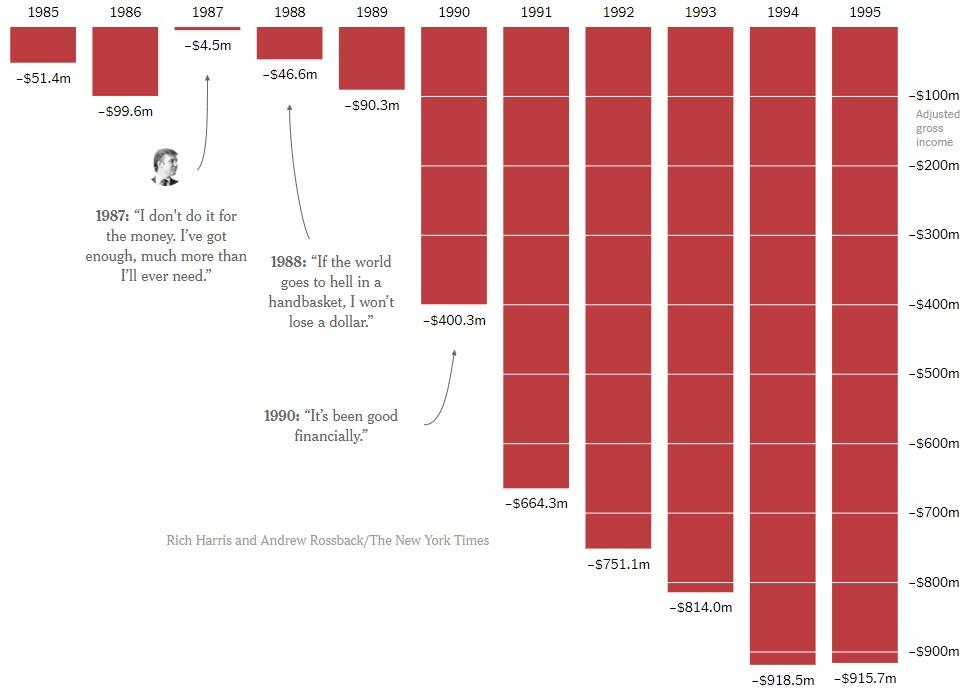

Now, somehow, the

New York Times has gotten hold of tax numbers for Trump’s returns for the years 1985-1994. While the

Times did not (so far as we know) obtain Trump’s actual returns, they did manage to come into possession of printouts of official IRS tax transcripts taken off the 1040 tax form —

by someone who had legal access to them, and chose to leak them to the media.

Much of the media and political response to the criminal act of delivering private tax information to a major American newspaper focused on what the numbers revealed — Trump did not pay any taxes during a time that he lost in excess of one billion dollars. That is not too surprising — people ordinarily pay income taxes when they make money, not when they lose money.

The years in which Trump lost so much money involved the years in which federal tax law changed, making free-wheeling real estate investments like Trump was prone to do much less lucrative. For his part, Trump’s lawyer, Charles Harder, said the information was “demonstrably false,” and “highly inaccurate.”

The information, if accurate, reveals that Trump lost money on various other investments, as well, including the Eastern Airlines shuttle ($365 million). With such heavy financial reverses, it is not surprising that Trump paid no federal income taxes for eight of the 10 years covered in the summaries.

But the larger question is just how did the

Times obtain this information? Section 6103 of the Internal Revenue Code makes it a

felony for current and former federal (and even state and local) officials to disclose tax information on a taxpayer to anyone without authorization — even to other government officials.

Just because someone dislikes Trump or his policies, or both, is not justification to break the law and disseminate any citizen’s private income tax information — even if that citizen lives in the White House. Some, of course, argue that Trump should not care if his private tax information is released unless he has “something to hide.” Really? So, these Trump-haters are willing to throw out hundreds of years of our legal protections just to “get” Trump? If the standard is that we should open our private papers to anyone, or otherwise we have “something to hide,” then what have we become?

This use of the IRS to go after political opponents is nothing new. Under the Obama administration, IRS official Lois Lerner was accused of going after dozens of conservative-leaning organizations, including the Tri-Cities Tea Party based in Washington State — by delaying their tax-exempt status, all as a result of Lerner and her IRS bureaucrats not liking their politics. Instead of bringing the hammer down on this abuse, President Barack Obama declared there was “not a smidgeon of corruption” at the IRS.

It did not start with Obama, either. According to Victor Lasky, in his book

It Didn’t Start With Watergate, President John Kennedy somehow knew exactly how much in income taxes had been paid by tycoons such as J. Paul Getty and H.L. Hunt. Also, while Kennedy was president, a list of “right-wing” organizations was compiled for possible harassment by the IRS, according to Lasky. Groups targeted included The John Birch Society, Dr. Fred Schwartz’s Christian Anti-Communist League, and H.L. Hunt’s “Life Lines.” Not surprisingly, audits soon followed as President Kennedy himself said that federal government should make sure that tax-exempt groups needed to be scrutinized. Senator Maurine Neuberger demanded the cancellation of the tax-exempt status of conservative groups, saying, “It is painfully clear that the tax service has not done the job Congress gave it, to rout out the propagandists.”

This vividly illustrates that the use of the IRS to defend the Left did not begin with attacks upon President Trump. During the Watergate scandal, confidential tax information was even leaked to the press on supporters of President Richard Nixon, such as John Wayne, Sammy Davis, Jr., Frank Sinatra, Jerry Lewis, Richard Boone, and Ronald Reagan.

Again, it may be the use of the federal income tax laws for the advantage of the Left (regardless of who resides at 1600 Pennsylvania Avenue) is just too tempting, just as that fruit in the Garden of Eden proved too tempting to Adam and Eve. We can decry the abuse of the IRS, but as long as the 16

th Amendment remains, such abuse is likely to continue. But arrests and prosecution would be justified, and welcome.

https://www.thenewamerican.com/usnew...ax-revelations

Reply With Quote

Reply With Quote

Connect With Us