Police in Hong Kong battled pro-democracy demonstrators on Christmas as unrest is expected to roll into the new year. Many residents have had enough of the sustained protests, are now fleeing the city, and buying homes abroad, reported Bloomberg.

Real estate brokers in top housing markets across the world have reported an uptick in interest in December from Hongkongers:

"There's been an increase in capital outflows from Hong Kong-based investors into other major global real estate markets, with Australia, Singapore, Japan, and the U.S. all seeing an increase in purchasing activity," said Ben Burston, Knight Frank LLP's Australia-based chief economist.

And with Hong Kong real estate some of the priciest in the world, an exodus of residents is disastrous news for a fragile market that could soon see fire sales and the eventual topping of the market.

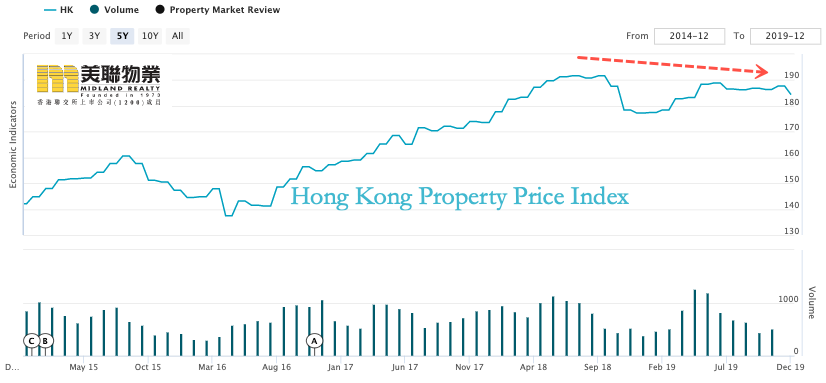

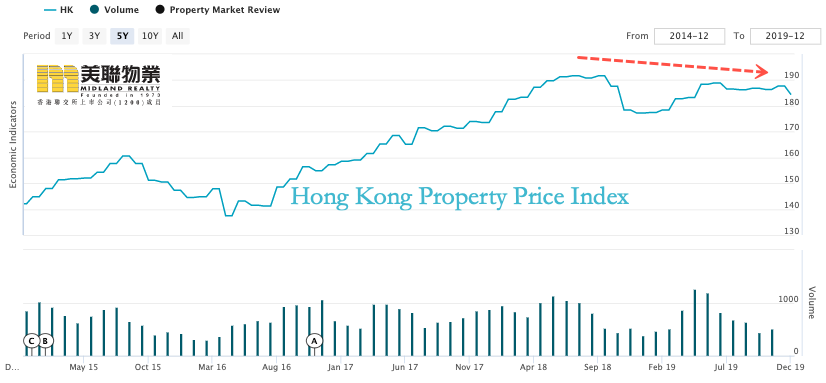

Hong Kong property market exhibiting symptoms of a possible double top.

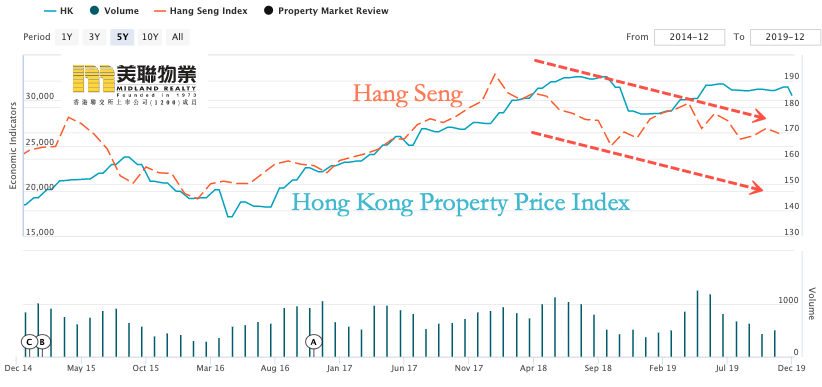

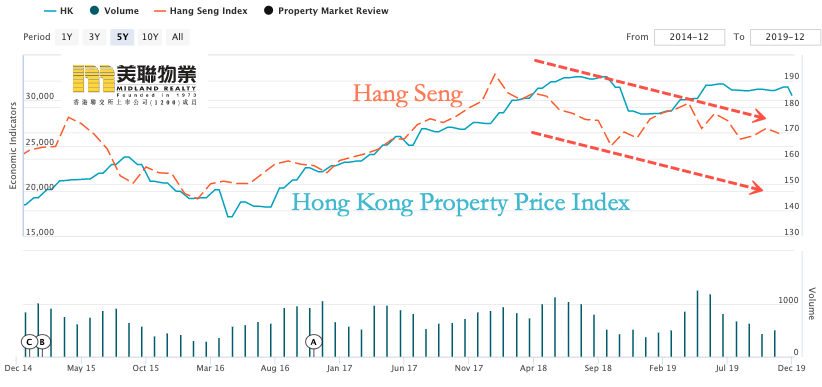

Hong Kong property market and regional stock market index are both under pressure.

More at: https://www.zerohedge.com/markets/es...tests-continue

Reply With Quote

Reply With Quote

Connect With Us