Trump helps sanctioned Chinese phone maker after China delivers a big loan to a Trump project

Trump stands to gain from an Indonesian project that got a $500 million loan right before he flip-flopped on ZTE.

May 15, 2018, 3:00pm EDT

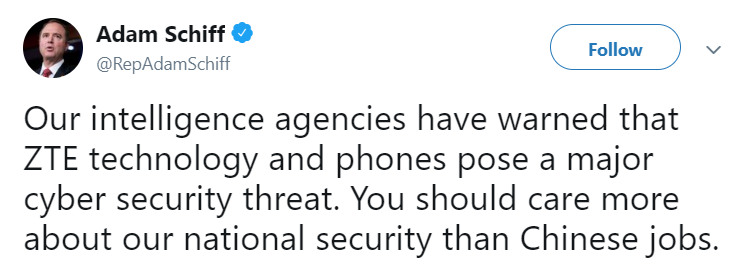

Thomas Peter-Pool/Getty Images Is the president of the United States revising American trade policy — and possibly jeopardizing national security — because his family received a large cash bribe from the Chinese government?

Under normal political circumstances, it would be an outrageous accusation to level. But under the political circumstances of 2018, there is suggestive evidence that it possibly happened —but the 24/7 din of controversy and scandal meansthat very little attention is being paid to the possibility. The constant tumult of the Trump Show — who’s leaking, who’s being mean to John McCain’s family, why is the president always lying about golfing, etc. — manages to crowd out not just big-picture policy coverage but also genuine malfeasance that has real, negative impacts on people’s lives.

“The controversies,”

David Frum warned a week after Election Day 2016, “will divert you from the scandals.”

And that’s what seems to be going on this week, when two below-the-radar stories — one about hotel financing in Indonesia and one about low-end smartphone sales in the United States — have a striking and potentially quite disturbing intersection. Here’s what we know so far.

ZTE and Lido City: a chronology

ZTE is a Chinese telecommunications equipment manufacturer that, among other things, manufactures Android smartphones, primarily on the cheaper, lower end of the market. Like most big Chinese companies, ZTE has various ties to the Chinese government, and there have long been questions about the security implications of relying on foreign firms with government links for sensitive communications roles. But separate from that longstanding controversy, ZTE had been in intense trouble lately for a largely unrelated issue pertaining to US sanctions policy.

- Back in March 2017, ZTE was hit with a record $1.19 billion fine for violating US law by selling technology products containing US components in North Korea and Iran. The fine set a record both because of the volume of ZTE’s illicit business and because ZTE was found to have tried to deceive US government officials and even its own accounting firm.

- About a year later — on March 12, 2018 — the Trump administration prevented a Singaporean company called Broadcom from buying a US company called Qualcomm. Qualcomm makes chips that are used in many smartphones, and the US government said Broadcom’s links to the Chinese government made it too risky to allow the company to purchase a key player in a strategic industry.

- Then on April 15, the Commerce Department hit ZTE again, saying that despite the earlier fine and settlement, ZTE had continued to violate US sanctions law and lie to the US government. The new order simply barred American companies from selling anything to ZTE.

- On May 8, the Trump administration pulled out of the Joint Comprehensive Plan of Action with Iran and began the process of trying to make US sanctions on Iran even more stringent in hopes of crippling the Iranian economy.

- On May 9, ZTE announced that it was going to have to shut down its entire smartphone business since it had no viable way to continue operating without Qualcomm chips.

- On May 11, a state-owned Chinese construction company called the Metallurgical Corporation of China announced it would float a $500 million loan to Indonesian developers to facilitate the construction of a vast “integrated lifestyle resort” called MNC Lido City that includes Trump-branded hotels, residences, and a golf course.

- On May 13, Trump tweeted: “President Xi of China, and I, are working together to give massive Chinese phone company, ZTE, a way to get back into business, fast. Too many jobs in China lost. Commerce Department has been instructed to get it done!”

- On May 14, Trump tweeted about ZTE again: “ZTE, the large Chinese phone company, buys a big percentage of individual parts from U.S. companies. This is also reflective of the larger trade deal we are negotiating with China and my personal relationship with President Xi.”

Why did Trump change course on ZTE?

It’s of course possible to interpret Trump’s rapid turnabout on the ZTE issue as reflecting what

Ana Swanson, Mark Landler, and Keith Bradsher of the New York Times term “another twist in the pitched battle inside the White House between the economic nationalists, who channel Mr. Trump’s protectionist instincts, and more mainstream advisers, who worry about the effects of hard-line policies on the stock market and long-term economic growth.”

Reply With Quote

Reply With Quote

Thomas Peter-Pool/Getty Images Is the president of the United States revising American trade policy — and possibly jeopardizing national security — because his family received a large cash bribe from the Chinese government?

Thomas Peter-Pool/Getty Images Is the president of the United States revising American trade policy — and possibly jeopardizing national security — because his family received a large cash bribe from the Chinese government?

Connect With Us