Why Is the GOP Terrified of Tariffs?

By Patrick J. Buchanan

From

Lincoln to

William McKinley to

Theodore Roosevelt, and from

Warren Harding through

Calvin Coolidge, the Republican Party erected the most awesome manufacturing machine the world had ever seen.

And, as

the party of high tariffs through those seven decades, the GOP was rewarded by becoming America’s Party.

Thirteen Republican presidents served from 1860 to 1930, and only two Democrats. And Grover Cleveland and Woodrow Wilson were elected only because the Republicans had split.

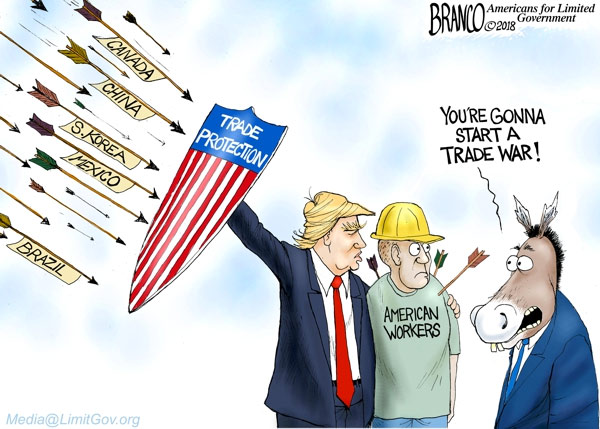

Why, then, this terror of tariffs that grips the GOP?

Consider. On hearing that President Trump might impose tariffs on aluminum and steel, Sen. Lindsey Graham was beside himself: “Please reconsider,” he implored the president, “you’re making a huge mistake.”

Twenty-four hours earlier, Graham had confidently assured us that war with a nuclear-armed North Korea is “worth it.”

“All the damage that would come from a war would be worth it in terms of long-term stability and national security,” said Graham.

A steel tariff terrifies Graham. A new Korean war does not?

“Trade wars are not won, only lost,” warns Sen. Jeff Flake.

But this is ahistorical nonsense.

The U.S. relied on tariffs to convert from an agricultural economy in 1800 to the mightiest manufacturing power on earth by 1900.

Bismarck’s Germany, born in 1871, followed the U.S. example, and swept past free trade Britain before World War I.

Does Senator Flake think Japan rose to post-war preeminence through free trade, as Tokyo kept U.S. products out, while dumping cars, radios, TVs and motorcycles here to kill the industries of the nation that was defending them. Both Nixon and Reagan had to devalue the dollar to counter the predatory trade policies of Japan.

Since Bush I, we have run $12 trillion in trade deficits, and, in the first decade in this century, we lost 55,000 factories and 6,000,000 manufacturing jobs.

Does Flake see no correlation between America’s decline, China’s rise, and the $4 trillion in trade surpluses Beijing has run up at the expense of his own country?

The hysteria that greeted Trump’s idea of a 25 percent tariff on steel and 10 percent tariff on aluminum suggest that restoring this nation’s economic independence is going to be a rocky road.

In 2017, the U.S. ran a trade deficit in goods of almost $800 billion, $375 billion of that with China, a trade surplus that easily covered Xi Jinping’s entire defense budget.

If we are to turn our $800 billion trade deficit in goods into an $800 billion surplus, and stop the looting of America’s industrial base and the gutting of our cities and towns, sacrifices will have to be made.

But if we are not up to it, we will lose our independence, as the countries of the EU have lost theirs.

Specifically, we need to shift taxes off goods produced in the USA, and impose taxes on goods imported into the USA.

As we import nearly $2.5 trillion in goods, a tariff on imported goods, rising gradually to 20 percent, would initially produce $500 billion in revenue.

All that tariff revenue could be used to eliminate and replace all taxes on production inside the USA.

As the price of foreign goods rose, U.S. products would replace foreign-made products. There’s nothing in the world that we cannot produce here. And if it can be made in America, it should be made in America.

Consider. Assume a Lexus cost $50,000 in the U.S., and a 20 percent tariff were imposed, raising the price to $60,000.

What would the Japanese producers of Lexus do?

They could accept the loss in sales in the world’s greatest market, the USA. They could cut their prices to hold their U.S. market share. Or they could shift production to the United States, building their cars here and keeping their market.

How have EU nations run up endless trade surpluses with America? By imposing a value-added tax, or VAT, on imports from the U.S., while rebating the VAT on exports to the USA. Works just like a tariff.

The principles behind a policy of economic nationalism, to turn our trade deficits, which subtract from GDP, into trade surpluses, which add to GDP, are these:

- Production comes before consumption. Who consumes the apples is less important than who owns the orchard. We should depend more upon each other and less upon foreign lands.

- We should tax foreign-made goods and use the revenue, dollar for dollar, to cut taxes on domestic production.

- The idea is not to keep foreign goods out, but to induce foreign companies to move production here.

- We have a strategic asset no one else can match. We control access to the largest richest market on earth, the USA.

- And just as states charge higher tuition on out-of state students at their top universities, we should charge a price of admission for foreign producers to get into America’s markets.

And — someone get a hold of Sen. Graham — it’s called a tariff.

https://buchanan.org/blog/gop-terrified-tariffs-128840

Reply With Quote

Reply With Quote

Connect With Us