Researchers at Purdue University recently studied data culled from across the globe and found that “happiness” doesn’t rise indefinitely with income. In fact, there were cut-off points at which more annual income had a negative effect on overall life satisfaction.

So, what’s that number? In the U.S., $65,000 was found to be the optimal income for “feeling” happy.

While the media jumped on the headline, given median national incomes are closing in on $60,000, they should have actually read the rest of the study.

The income figure is per individual.

So to calculate the required income number for “happiness” you must multiply that number by the square root of the household size. So, what’s the number for a couple, or a family of three or four?

- $65,000 x √2 = $92,000/year

- $65,000 x √3 = $112,000/year

- $65,000 x √4 = $130,000/year

That is an entirely different message from what most have been led to believe. An income of $130,000/year is far above the average incomes from most Americans currently and ability to maintain the basic lifestyle is becoming ever more problematic.

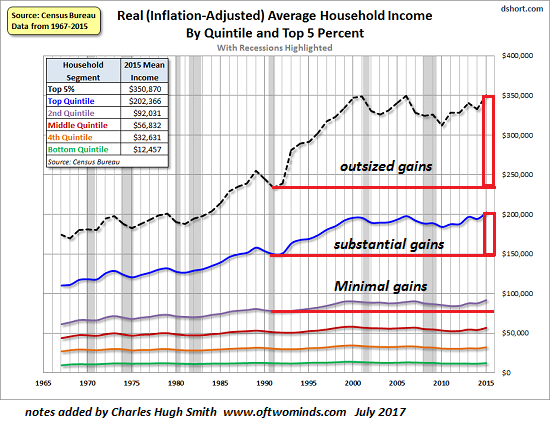

In the U.S., despite higher levels of low income (now there’s an oxymoron), inflation-adjusted median incomes have remained virtually stagnant since 1998.

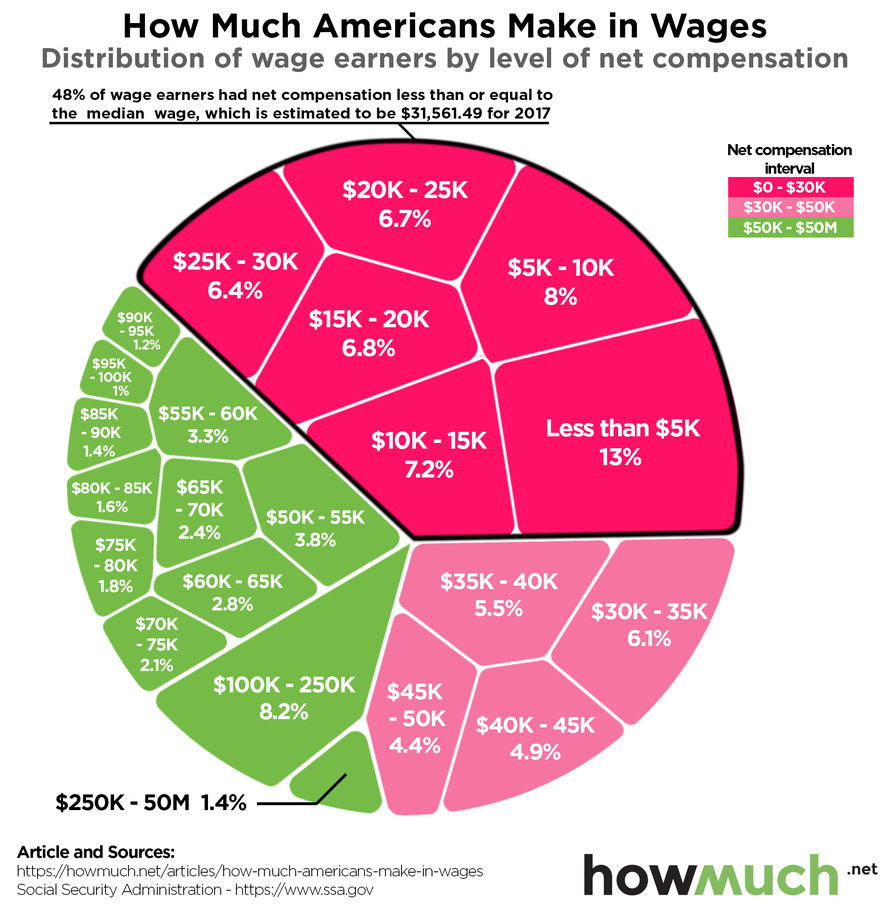

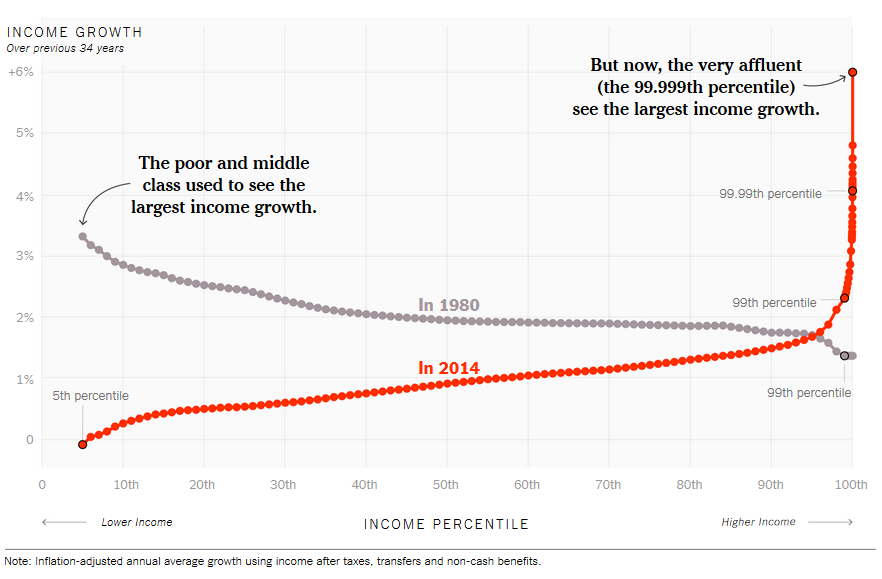

However, the chart above is grossly misleading because the income gains have only occurred in the Top 20% of income earners. For the bottom 80%, they are well short of the incomes needed to obtain “happiness.”

For most American “families”, who have to balance their living standards to their income, the “experience” of “happiness” is more of a function of “meeting obligations” each and every month.

Today, more than ever, the walk to the end of the driveway has become a dreaded thing as bills loom large in the dark crevices of the mailbox. If they can meet those obligations, they are “happy.” If not, not so much.

The Financial Crisis Mindset

In my opinion, what the study failed to capture was the “change” in what was required to achieve “perceived” happiness following the “financial crisis.”

Just as with “The Great Depression,” individuals forever altered their feelings about banks, saving and investing after an entire generation had lost “everything.” It is the same today as sluggish wage growth has failed to keep up with the cost of living which has forced an entire generation into debt just to make ends meet.

As the chart below shows, while savings spiked during the financial crisis, the rising cost of living for the bottom 80% has outpaced the median level of “disposable income” for that same group. As a consequence, the inability to “save” has continued.

So, if we assume a “family of four” needs an income of $132,000 a year to be “happy,” such becomes problematic for the bottom 80% of the population whose wage growth falls far short of what is required to support the standard of living, much less to obtain “happiness.”

The “gap” between the “standard of living” and real disposable incomes is more clearly shown below. Beginning in 1990, incomes alone were no longer able to meet the standard of living so consumers turned to debt to fill the “gap.”

However, following the “financial crisis,” even the combined levels of income and debt no longer fill the gap. Currently, there is almost a $7000 annual deficit that cannot be filled.

The mirage of consumer wealth has been a function of surging debt levels which was accumulated during the credit boom. The problem is the debt simply can’t be disposed of through ordinary means.

- Many can’t sell their house because they can’t qualify to buy a new one

- The cost to rent is now higher than current mortgage payments in many places

- There is no ability to substantially increase disposable incomes because of deflationary wage pressures; and,

- Despite the mainstream spin on recent statistical economic improvements, the burdens on average American families are increasing namely in the things they can’t control – health care, energy, and housing.

Nothing brought this to light more than the recent release of the Fed’s Report on “The Economic Well-Being Of U.S. Households.” The overarching problem can be summed up in one chart:

This isn’t just about the “baby boomers,” either.

Millennials are haunted by the same problems, with 40%-ish unemployed, or underemployed, and living back home with parents. In turn, parents are now part of the “sandwich generation” that are caught between taking care of kids and elderly parents. The rise in medical costs and health care goes unabated consuming more of their incomes.

More importantly, despite economic reports of rising employment, low jobless claims, surging corporate profitability and continuing economic expansion, the percentage of government transfer payments (social benefits) as compared to disposable incomes have surged to the highest level on record.

More Money

Of course, by just looking at household net worth, once again you would not really suspect a problem existed. In the Fed’s latest Flow of Funds report, the Fed revealed households currently held $112.4 trillion in assets with just a modest $15.4 trillion in liabilities, which brought the net worth of the average US household to a new all-time high of $96.9 trillion. The majority of the increase over the last several years has come from increasing real estate values and the rise in various stock-market linked financial assets like corporate equities, mutual and pension funds.

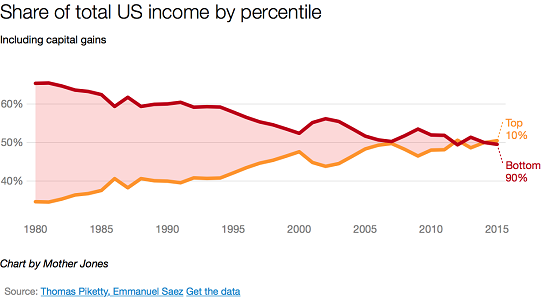

However, once again, the headlines are deceiving even if we just slightly scratch the surface. Given the breakdown of wealth across America we once again find that virtually all of the net worth, and the associated increase thereof, has only benefited a handful of the wealthiest Americans.

Despite the mainstream media’s belief that surging asset prices, driven by the Federal Reserve’s monetary interventions, has provided a boost to the overall economy, it has really been anything but. Given the bulk of the population either does not, or only marginally, participates in the financial markets, the “boost” has remained concentrated in the upper 10%. The Federal Reserve study breaks the data down in several ways, but the story remains the same – “if you are wealthy – life is good.”

The illusion by many of ratios of “economic prosperity,” such as debt-to-income ratios, wages, assets, etc., is they are heavily skewed to the upside by the top 20%. Such masks the majority of Americans who have an inability to increase their standard of living.

While the ongoing interventions by the Federal Reserve have certainly boosted asset prices higher, the only real accomplishment has been a widening of the wealth gap between the top 10% of individuals that have dollars invested in the financial markets and everyone else. What monetary interventions have failed to accomplish is an increase in production to foster higher levels of economic activity.

Of course, when couples are stressed financially, they also become stressed “sexually.”

Less Sex

Not surprisingly, the “financial stress” in American households is leading to other factors which are fueling the “demographic” problem in the future. The equation is very simple – when individuals are stressed over finances they are less active sexually.

This was shown in a recent study by the National Bureau of Economic Research. Ahead of the past three US recessions, the number of conceptions began to fall at least six months before the economy started to contract. As the FT notes, while previous research has shown how birth rates track economic cycles, the scientific study is the first to show that fertility declines are a leading indicator of recessions.

Daniel Hungerman, economics professor at the University of Notre Dame and one of the report’s authors, said

“It is ‘striking’ that the drop in pregnancies was evident before the recession that came after the 2007 financial crisis, since it has traditionally been argued that this slump had been hard to predict.”The analysis used data on the 109 million births in the US between 1989-2016 to examine how fertility rates changed through the last three economic cycles — in the early 1990’s, the early 2000’s, and the late 2000’s. A similar pattern emerged in all three cases.

In other words, less sex with the intent to procreate.

“One way to think about this is that the decision to have a child often reflects one’s level of optimism about the future,” says Kasey Buckles, another Notre-Dame professor and co-author of the study. Research published through the NBER is often conducted by academics at their own universities.To the researchers’ surprise, they found that falls in conceptions were a far better leading indicator of recessions than many commonly used indicators such as consumer confidence, measures of uncertainty, and purchases of big-ticket items such as washing machines and cars.

Of course, this decline in fertility, fuels one of the primary problems facing the U.S. over the next 30-years – the decline in the ratio of workers per retiree or “demographics.” As retirees are living longer (increasing the relative number of retirees), and lower birth rates (decreasing the relative number of workers.)the “support ratio” is falling sharply.

The problem for American families today, despite media commentary to the contrary, is simply the inability to maintain their current standard of living. When incomes remain stagnant, or falls, due to job loss or reduction in pay, the impact on the budget at home is significant when there are already very low saving rates and the inability to access a tight credit market. The recent surge in consumer debt, with little relative increase in overall personal consumption expenditures, shows this to be the case. For Main Street, the economy remains mired at sub-par growth rates ten-years into a post-recessionary environment.

More at: https://www.zerohedge.com/news/2018-...oney-happiness

Site Information

About Us

- RonPaulForums.com is an independent grassroots outfit not officially connected to Ron Paul but dedicated to his mission. For more information see our Mission Statement.

Reply With Quote

Reply With Quote

Connect With Us