While Hawaii has seen a slight improvement, the state is still among one of the worst when it comes to economic freedom, according to a new report by the Grassroot Institute of Hawaii.

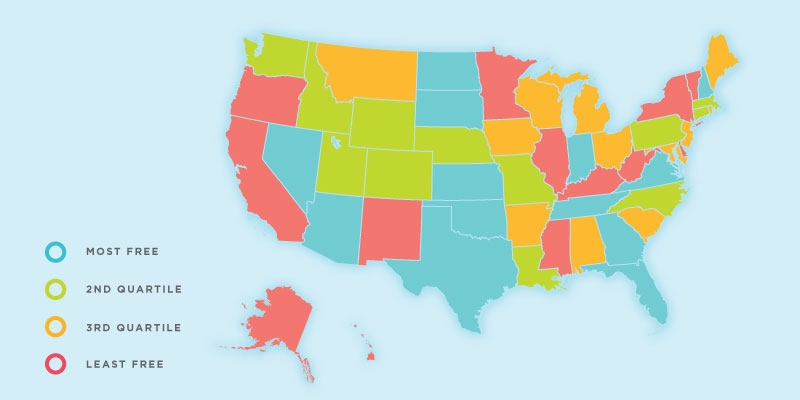

The *Economic Freedom of North America*report, which was released in conjunction with Canada’s Fraser Institute, placed Hawaii 45th out of the 50 states, up from 46th the year before.

Kelii*Akina, president of the Grassroot Institute of Hawaii cited “onerous taxation and regulation” as the primary drivers behind the state’s low ranking.

The report measures government spending, taxation and labor market restrictions, using data from 2015, the most recent year of available comparable data.

“The Economic Freedom index is a good way to measure government interference in the free market,”*Akina*said in a statement. “Unfortunately, in Hawaii, we find that red tape and excessive taxes have throttled our economic freedom, thus raising the cost of doing business, limiting economic growth in the state.”

According to the report, Hawaii scored worst for its top marginal income tax rate, its income tax and payroll tax revenues as a percentage of income.

For the third year in a row, New Hampshire had the highest level of economic freedom among all U.S. states.

Reply With Quote

Reply With Quote

Connect With Us