In the latest attempt by Europe to create a common bond market, a European Commission paper on the future of the euro seen by the Financial Times, advocates the launching of a market of “sovereign bond-backed securities” — packaging different countries’ national debt into a new asset.

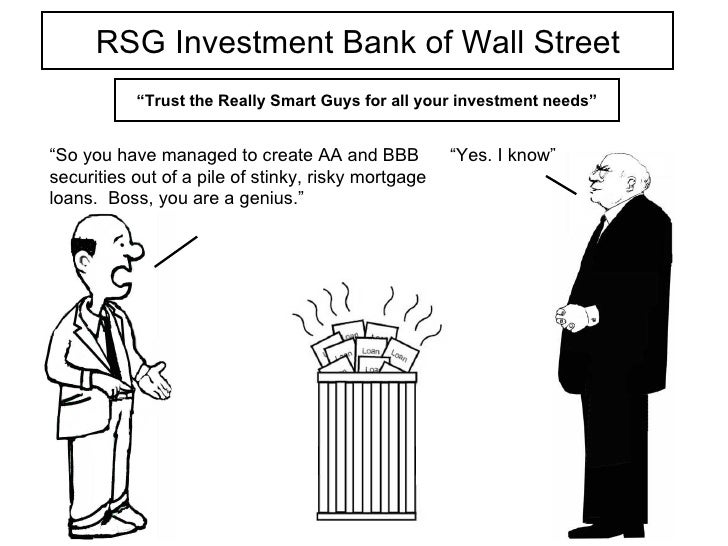

The logic is simple: combine all the debt from strong and weak countries into one big pool, eliminating the outliers on both sides, then tranche it out, and sell it based on required yield returns.

Officials hope that the plans would boost demand for debt issued by governments with relatively weaker economies, and encourage banks to manage their risks better by diversifying their portfolios, while avoiding old political battles over whether the currency bloc should issue common bonds.

Why now? Because as has been Germany's intention all along, Berlin has been hoping to create a fiscally intergrated Europe (with a shadow government in Berlin of course), call it a (quasi) "fiscal union", and which is much more stable and resilient than the current iteration which is only as strong as its weakest link. Securitizing the sovereign debt resolves virtually all outstanding problems.

The commission paper is the

latest in a series of efforts to kick-start integration inside the eurozone. Such integration efforts have stalled since financial markets became convinced in 2013 that the European Central Bank would not allow the eurozone to break up. The last successful integration project was the creation of an EU banking union three years ago.

More at:

http://www.zerohedge.com/news/2017-0...sovereign-debt

Reply With Quote

Reply With Quote

Connect With Us