MARCH 17, 2017

Why did the Fed raise its benchmark interest rate when inflation is still running below the Fed’s target, workers wages have hardly budged and the economy is not even growing at 1 percent?

Yellen was asked that question at a press conference on Wednesday following the release of the FOMC’s statement. Her answer helps to show how the Fed makes its policy decisions based on factors most people would never consider. Here’s what she said:

Janet Yellen– “Well, look, our policy is not set in stone. It is data-dependent and we’re — we’re not locked into any particular policy path…As you said, the data have not notably strengthened.”

Translation– So after saying the Fed bases its decisions on the data, Yellen does a quick 180 and says the data hasn’t changed. Okay.

Janet Yellen– “There’s always noise in the data from quarter to quarter. But we haven’t changed our view of the outlook.”

Trans– The Fed expects economic growth will remain in the doldrums. (2 percent or less)

Janet Yellen– “We haven’t boosted the outlook, projected faster growth.”

Trans– The Fed is determined to maintain a slow-growth environment in order to continue its “easy money” policy which benefits Wall Street.

Janet Yellen– “We think we’re moving along the same course we’ve been on, but it’s one that involves gradual tightening in the labor market.”

Trans — Ah ha. Now we’re getting somewhere. Now we can see what the rate hike is really all about. It’s all about the minuscule improvements in the labor market. Yellen thinks the improvements are a big red flag.

Janet Yellen– “I would describe some measures of wage growth as having moved up some.”

Trans– Battle Stations! Battle Stations! Full Red Alert!

Janet Yellen– “Some measures haven’t moved up, but there’s is also suggestive of a strengthening labor market.”

Trans– “Suggestive”? In other words, the mere hint of improving conditions in the labor market –which could result in higher wages –is enough to send Yellen into a rate-hike frenzy? Is that what she’s saying?

Janet Yellen– “And we expect policy to remain accommodative now for some time.”

Trans– So don’t worry Wall Street, we’re not cutting off the flow of cheap money, we just need to tweak rates a bit to dampen the prospect of higher wages.

Janet Yellen– “So we’re talking about a gradual path of removing policy accommodation as the economy makes progress moving toward neutral.”

Trans– We’re keeping our eyes peeled for even the slightest uptick in wages, but we’ll continue to price cash below the rate of inflation so the investor class can make out like bandits.

Janet Yellen– “But we’re continuing to provide accommodation to the economy that’s allowing it to grow at an above-trend pace that’s consistent with further improvement in the labor market.”

Trans– We’ll make sure the economy doesn’t grow any faster than 2 percent GDP for the foreseeable future so we can continue to provide cheap credit to our constituents on Wall Street who need money that is priced below the rate of inflation to push stocks and bonds higher into the stratosphere. Also, we think that rising wages are merely a fleeting blip on the radar, even so, we are prepared to raise rates until the threat has been thoroughly extinguished.

So the Fed hasn’t changed its policy or its projections. Yellen basically raised rates because she had a ‘gut-feeling’ that the demand for labor is strengthening which means that wages could rise. (Her feelings on this matter are not supported by the data, but whatever.) As the primary steward of the system, it’s Yellen’s job to make sure that doesn’t happen. Any sign that of improvement in labor markets (like higher wages or, god forbid, rising standards of living) must be squelched before they ever get started. At the same time, the Fed has to balance its anti-worker duties with its stealth mandate to shower the investor class with below market-priced credit to help them game the system and rake off hefty profits. It’s a tough job, but the Fed has proved that it’s more than ready to meet the challenge.

The idea that the Fed is an impartial referee that serves the public by setting interest rates and regulating the financial system, is the nuttiest of all the conspiracy theories. The Fed is not only a creature of the banks, it is also the most destructive institution in the country today. Just look at the growing social unrest, the political instability and the sudden surge in right wing movements. Does anyone seriously believe these phenomena just popped out of nowhere? These are all the result of the gaping inequality that has emerged under the Fed’s malign stewardship. There’s nothing accidental in the way that wealth has been transferred from one class to another. It’s all part of a plan, a plan to enrich the few while everyone sees their incomes shrivel, their wages stagnate, the health care costs soar, their education expenses explode, their personal debts balloon, and their standards of living steadily decline.

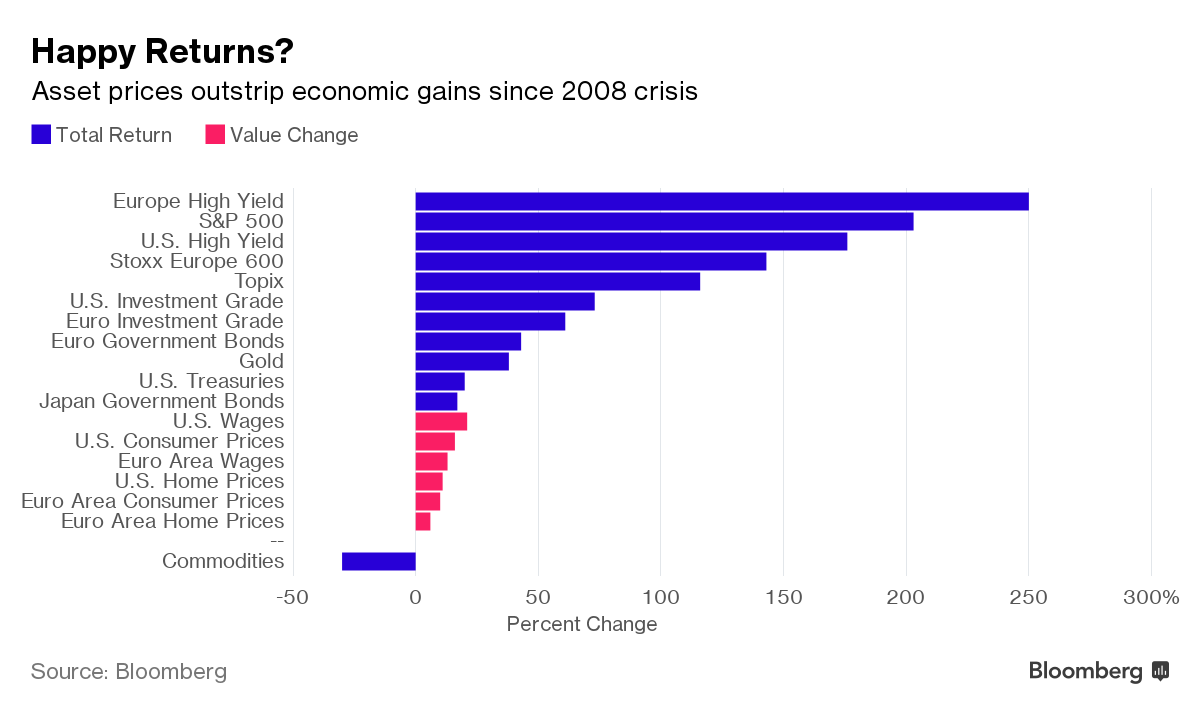

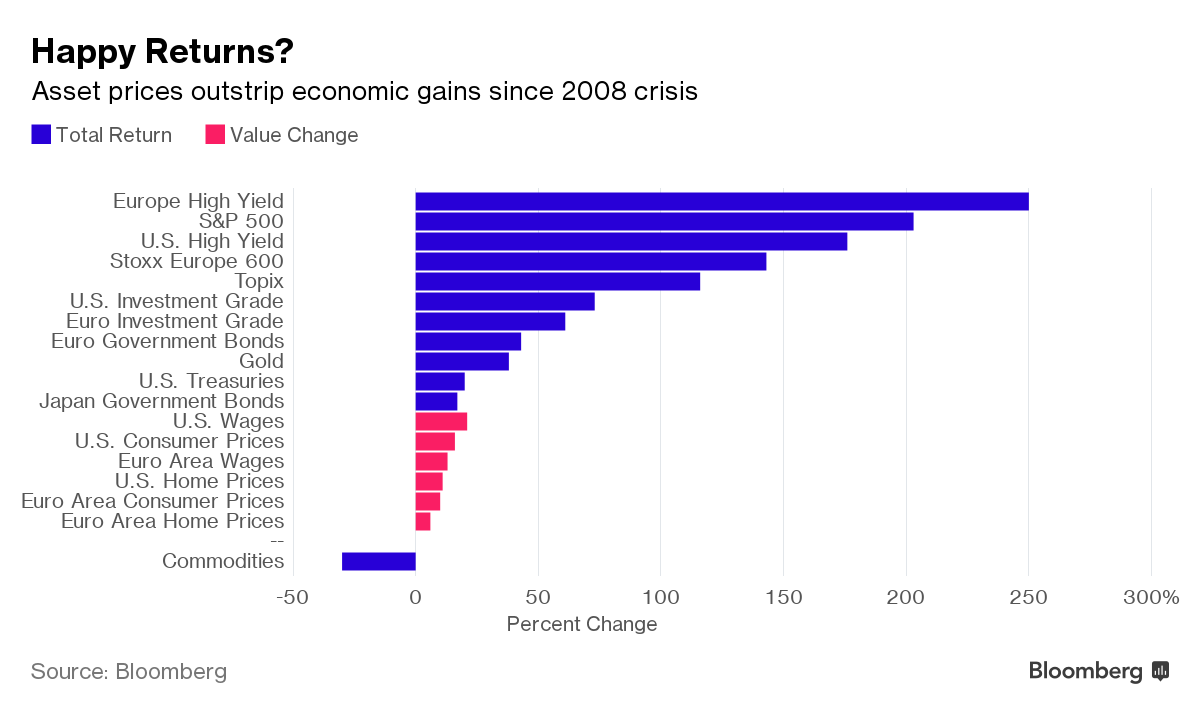

Check out this chart from Bloomberg that shows with stunning clarity the real impact the Fed’s misguided policies. Rather than try to persuade readers that the Fed is a thoroughly corrupt and heinous institution that is a threat to every man, woman and child in the USA, I ask readers to study the chart and draw your own conclusions. The question that arises is this: Did the Fed choose the policy that would best serve the interests of the American people (by restoring economic growth and increasing employment) or did they choose a policy that they knew would maximize the profits for the investor class at the expense of everyone else?

You decide.

(Here’s One Chart That Captures the Debate Over Quantitative Easing, Bloomberg)

(Here’s One Chart That Captures the Debate Over Quantitative Easing, Bloomberg)

One more thing: How much of our fractious and increasingly-polarized political culture is the result of economic and monetary policies that have intensified feelings of hopelessness among the public? Would the American people have voted for a rightwing demagogue unless they were so desperate about the slide in their standards of living that they felt compelled to look for remedies outside the political mainstream?

Isn’t it true that Donald Trump wouldn’t be president today if it wasn’t for the Fed?

Think about it.

Reply With Quote

Reply With Quote

Connect With Us