---

The Biggest Threat to National Security is the Debt

http://www.thefiscaltimes.com/Column...-Trillion-Debt

There have been debates, bluster, TV coverage, and more, but you know what’s been lacking in this Presidential race…a serious discussion of the debt, deficit, and government spending. …

In just ten years, there will only be enough money coming into the federal government to pay for interest and entitlements…and nothing else. … It will mean dire things for interest rates, inflation, and the value of the dollar…and by extension the value of all you possess and plan to retire on.

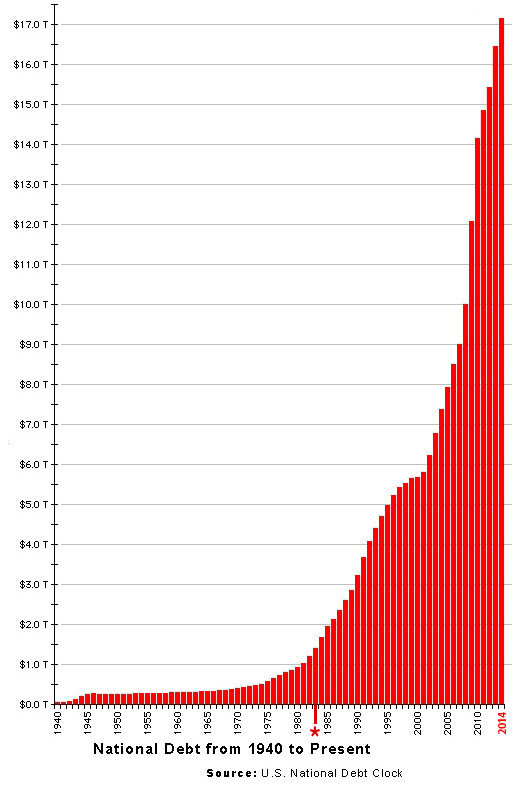

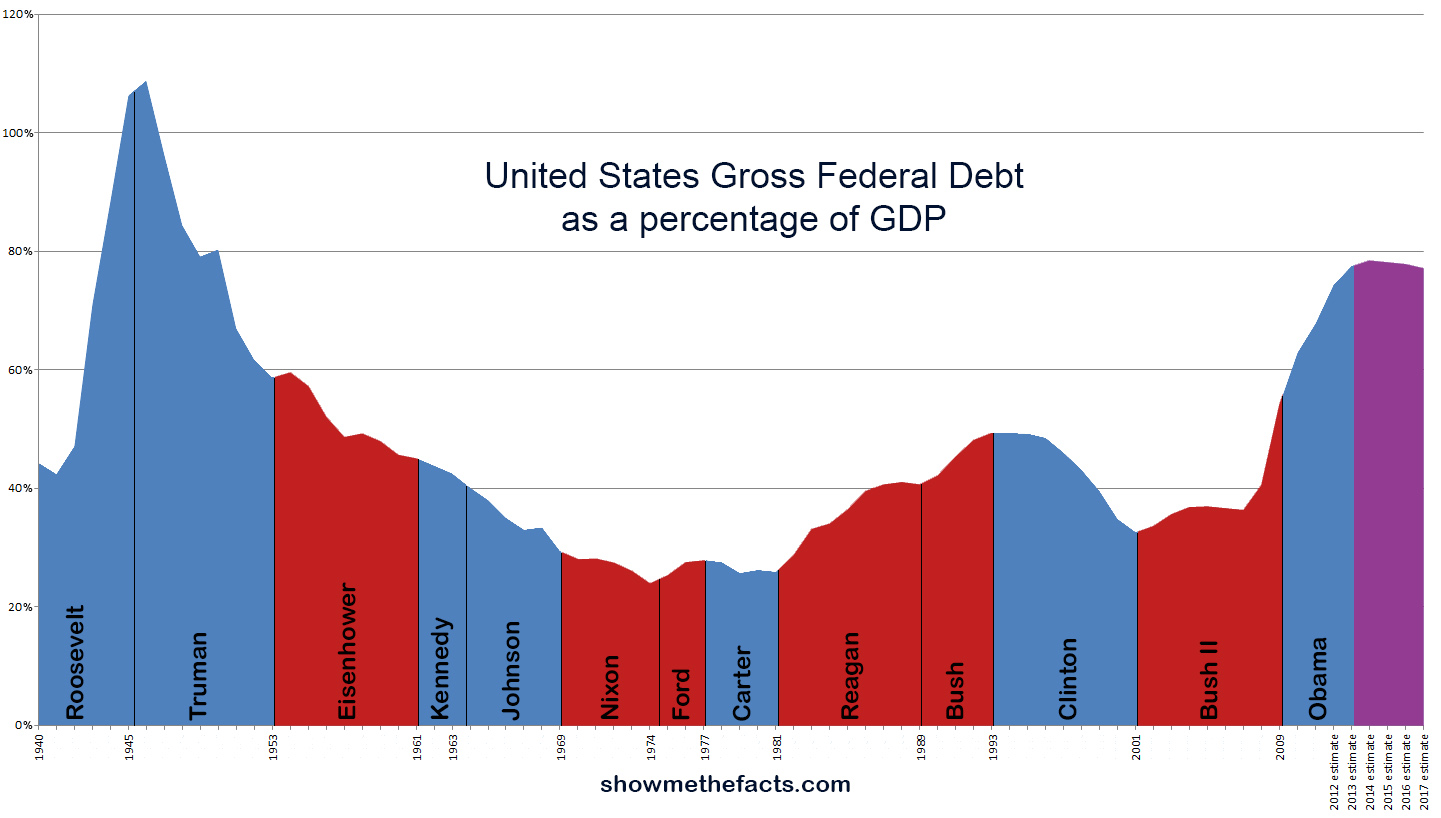

The growth in the federal government debt is becoming geometric. … it took two hundred years for our nation to accumulate $5 trillion in debt, yet during just the eight years of the George W. Bush presidency, it doubled and moved from $5 to $10 trillion. Now in the Obama presidency, it is doubling again, moving from $10 to $20 trillion. A freight train is coming at us, and we are not discussing it. Most frightening is that it’s all scheduled to get much worse …

Finally, you can’t go much below zero in setting interest rates. The Fed has aided and abetted spending in Washington as it has kept interest rates artificially low. When rates return to historical norms, hundreds of billions will be added each year in interest cost at the federal governmental level. The Federal Reserve has actually done much more than this as its balance sheet swelled over the last few years from $850 billion in 2008 to $4.4 trillion today. Without the Fed buying Treasury paper as it’s done, there is no way the federal government could have run the deficits it has without inflation or taxation that would have caught the interest of Congress, voters…and maybe even Presidential candidates. …

Site Information

About Us

- RonPaulForums.com is an independent grassroots outfit not officially connected to Ron Paul but dedicated to his mission. For more information see our Mission Statement.

Reply With Quote

Reply With Quote

Connect With Us