Late last year and early this year, we wrote extensively about the problems we thought were coming down the pike for European banks. Very little attention was paid to the topic at the time, but we felt it was a typical example of a “gray swan” – a problem everybody knows about on some level, but naively thinks won’t erupt if only it is studiously ignored. This actually worked for a while, but as Clouseau would say: “Not anymeure!”

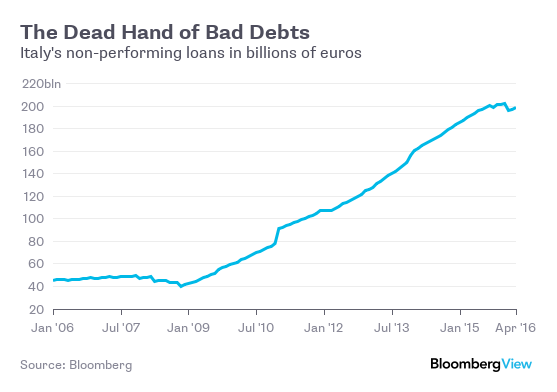

Readers may want to check these previous missives out, which provide a lot of background information and color (in chronological order: “Insolvent Zombies”, “Drowning in Bad Loans” and “The Walking Dead: Something is Rotten in the Banking System”). What is happening now is therefore a “told you so” moment, because, well… we told you so.

Following the “Brexit” vote, market participants have begun to focus their attention on what we thought they would focus it on: namely on the risks posed by continental Europe. Perversely, the mainstream press on the continent is brim-full with lamentations describing in lurid prose what an unmitigated catastrophe leaving the EU will be for the United Kingdom! (as we promised, we will write about this in more detail soon – it is truly funny to watch). In reality, the UK has left what increasingly looks like a sinking ship.

One bank that did get its share of unwelcome media attention was Europe’s biggest zombie, Deutsche Bank (NYSE

B). Its share price has continued to tumble relentlessly, for no immediately obvious reasons. In a way this is faintly reminiscent of Creditanstalt in 1931 – in the sense that Deutsche’s position in the European banking system of today is of roughly similar importance as Creditanstalt’s was back then. This is mainly due to its extremely large derivatives positions, which make it a lynchpin in a vast web of contractual obligations – it is so to speak the mother of all counterparties.

Reply With Quote

Reply With Quote

B). Its share price has continued to tumble relentlessly, for no immediately obvious reasons. In a way this is faintly reminiscent of Creditanstalt in 1931 – in the sense that Deutsche’s position in the European banking system of today is of roughly similar importance as Creditanstalt’s was back then. This is mainly due to its extremely large derivatives positions, which make it a lynchpin in a vast web of contractual obligations – it is so to speak the mother of all counterparties.

B). Its share price has continued to tumble relentlessly, for no immediately obvious reasons. In a way this is faintly reminiscent of Creditanstalt in 1931 – in the sense that Deutsche’s position in the European banking system of today is of roughly similar importance as Creditanstalt’s was back then. This is mainly due to its extremely large derivatives positions, which make it a lynchpin in a vast web of contractual obligations – it is so to speak the mother of all counterparties.

Connect With Us