The 21st Century has not been kind to equity investors in the United States:

What's more, it's been even less kind to those investing in stocks in other nations.

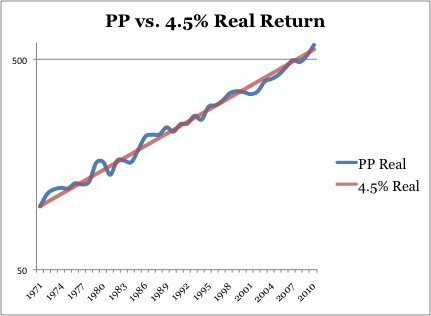

What to do? Where to hide? Even bank accounts give us virtually no interest today. How can we get actual real returns on our savings?

Site Information

About Us

- RonPaulForums.com is an independent grassroots outfit not officially connected to Ron Paul but dedicated to his mission. For more information see our Mission Statement.

Reply With Quote

Reply With Quote

Connect With Us