h/t Joe Salerno @ Mises.org (The Hocus-Pocus of CPI Calculation)

http://mises.org/blog/hocus-pocus-cpi-calculation

h/t Tyler Durden @ Zero Hedge (The Magic Of CPI: Watch How Economists Transform A 400% Price Increase Into A 7.1% Decline)

http://www.zerohedge.com/news/2014-1...ase-71-decline

[all emphasis in original - OB]

Manipulating the Consumer Price Index: Hedonic Quality Adjustments

http://priceillusion.wordpress.com/2...y-adjustments/

Consumer Price Illusion (04 November 2014)

Have you heard the one about CPI?

Suppose that a TV manufacturer retires a product and replaces it with a newer, better, and much more expensive one. If the new TV costs 5 times more than the old one, how can we gently massage the price of the old TV to make it look like the price fell? By using the dark arts of econometrics, my son!

If you believe the public comments made by the world’s central bankers, the prices that consumers pay for items are not rising fast enough; in some places like Europe they worry that prices might actually fall (a tragedy for the possessing classes, as their manic one-way long bets might not work then). Central bankers are terrified of this outcome. Setting aside for a second the apparent insanity of this logic for your average consumer, who experiences price rises on a near continuous basis, let’s examine in detail one of the gauges economists use for measuring prices: the Consumer Price Index (CPI).

Ostensibly, the CPI is a linear combination of the “prices” of things/stuff consumers could actually purchase weighted by a percentage that the “ideal consumer” spends on any particular stuff/thing in his “ideal” basket. The main problem here is that the “prices” used are not the prices a consumer would actually pay; instead the real price for an item is scaled by what the BLS calls a “Hedonic Quality Adjustment (HQA)”. The HQA was designed to solve a real world problem economists face: the market keeps pumping out new and better devices. In practice the HQA is used to artificially depress the prices used in the calculation of the CPI.

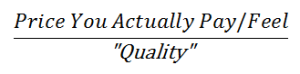

Intuitively, the HQA scales prices by their “perceived” quality. We’re not talking about human perception here, but that of a kitchen sink regression model created by BLS economists. Essentially it throws every quality an item might possess into a linear model and performs a regression of these qualities against the prices found in the market for a given product. The prices that feed into the CPI can be intuitively modeled as:

This means that as far as the CPI is concerned, prices can “decrease” for three reasons:

In a time of rapid technological development, the quality as measured by HQR will increase by orders of magnitude more than prices. Consider Moore’s Law, which correctly postulated that the number of transistors on computer chips would double every two years; prices can’t possibly keep up with that kind of quality increase (save for hyperinflation, more on that later).

- The price actually decreases, holding quality constant

- The “quality” as measured by the Hedonic Quality Regression (HQR) could go up, holding price constant

- The “quality” goes up by more than prices go up (<<<<<< WE’RE HERE RIGHT NOW)

The BLS neatly illustrates this effect with an example from their website (emphasis is mine):

This is just an OLS linear regression model. The dependent variable is the natural log of prices for televisions, the explanatory variables and their coefficients are listed in the table below (most are dummy variables).

Item A is a television that is no longer available and it has been replaced by a new television, Item B. The characteristics in bold differ between the two TVs. There is a large degree of quality change and there is a very large (400%) difference in the prices of these TVs. Rather than use the 400 percent increase in price between Item A and Item B, the quality adjusted rate of price change is measured by the ratio of the price of Item B in the current period ($1,250.00) over an estimated price of Item B in the previous period – Item B’.

Here is an example of a hedonic regression model [including coefficients] for televisions.

To put it another way, the HQR extrapolates a price for the new TV using the Hedonic Quality model estimated from the population of old TV’s.

To derive the estimated price of Item B’, we use the following equation:

Where PB,t+s-1 is the quality adjusted price, PA,t+s-1 is the price of Item A in the previous period, and is the constant e [SIC], the inverse of the natural logarithm, exponentiated by the difference of the summations of the ßs for the set of characteristics that differ between items A and B. The exponentiation step is done to transform the coefficients from the semi log form to a linear form before adjusting the price.

Oh good! You see, my neighbor, John Q., thought that prices were going up and was about to riot in the streets because he couldn’t buy anything now. How relieved he was to live next to an economist and mathematician; I merely explained that even though he couldn’t afford the new TV (or anything else) it was actually less expensive once quality was taken into account. Boy was his face red. He went home and explained it to his wife and kids and they laughed and laughed about their mistake.For our television example, [the equation above] looks like this:

When this quality adjustment is applied, the ratio of price change looks like this:

The resulting price change is -7.1 percent after the quality adjustment is applied.

Few modern people would consider progress to be a bad thing. Quality improvements should be celebrated and technological change embraced. Yet when a policymaker says that she wants inflation to pick up and trots out the CPI as evidence, she doesn’t care whether that comes about from actual price inflation or quality decreases. Given the accelerating pace of technological improvements, it’s hard to imagine an outcome besides hyperinflation that will satisfy central bankers and their slavish dependence on indicators which have been so far abstracted from reality as to have little actionable value.

Alternatively, causing a complete economic meltdown by manipulating the price of money and inflating the mother of all bubbles will probably slow down technological development, so either way, well played.

Since economists are largely concerned with “real” prices (actual prices scaled by inflation as measured by the CPI), any error in the calculation of real prices introduces a bias that propagates to every corner of economic thought. This is a central flaw in economics that largely explains the gap between actual human experiences (“Wow! Things are expensive!”) with central bankers gambling our collective future on fighting deflation.

More than likely the deflation is used as cover for the agency problem faced by central bankers every day. Most market practitioners know we are in a classic debt-fueled bubble initiated by wildly loose monetary policy – central bankers included. Given that the public will rightfully blame policymakers when the bubble bursts, no central banker wants to run the risk that it pops on their watch. That would make them look stupid, and might endanger their future lives as highly paid consultants. In that context printing endless supplies of money makes perfect sense.

Site Information

About Us

- RonPaulForums.com is an independent grassroots outfit not officially connected to Ron Paul but dedicated to his mission. For more information see our Mission Statement.

Reply With Quote

Reply With Quote

I don't know. You haven't specified any prices.

I don't know. You haven't specified any prices.

Those prices are for decent cuts of meat but not high quality grass fed. You'll pay more for that.

Those prices are for decent cuts of meat but not high quality grass fed. You'll pay more for that.

Connect With Us