Interesting article...

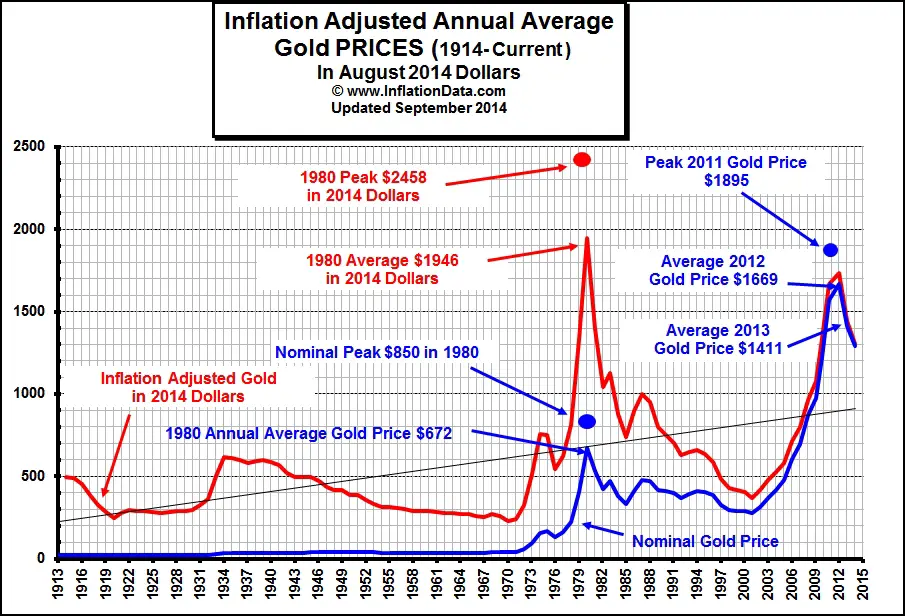

Time to Admit That Gold Peaked in 2011?

"According to some analysts, on an inflation-adjusted basis, gold has already matched its 1980s peak—but is that really true?"

Continued...

Site Information

About Us

- RonPaulForums.com is an independent grassroots outfit not officially connected to Ron Paul but dedicated to his mission. For more information see our Mission Statement.

Reply With Quote

Reply With Quote

Connect With Us