Originally Posted by

lotsOfCake

I'm just waiting for that moment where the market decides that "OK this is the bottom, right here", and we turn towards a longer uptrend.

Because if I knew perfectly when that was, i would buy back some LTC at that time (even if it might tank until the next bubble). If i knew.

Since I don't know, I have already bought. So I am betting on there being an upturn as the market flips.

So I'm waiting for an upturn. Might have to wait past the infamous April 15th, even if it is bull.

---------

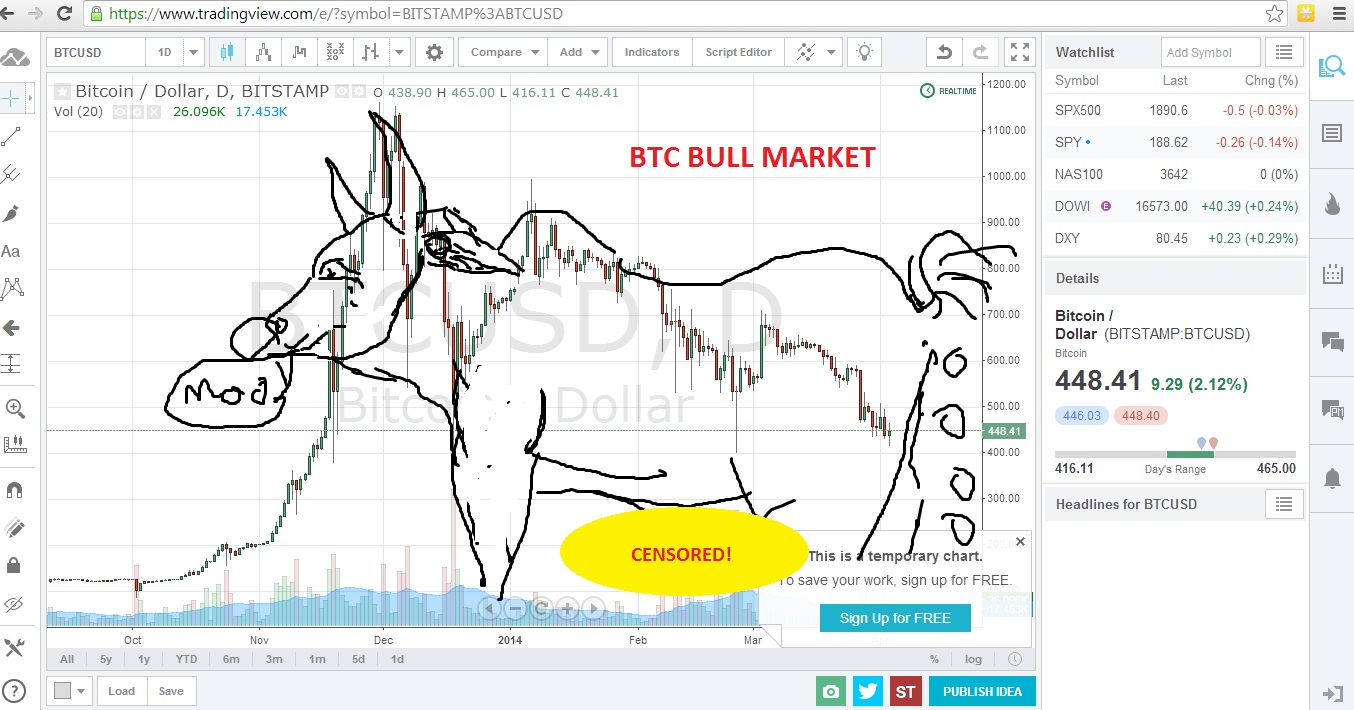

Another thing; there are the repeating bubble patterns in BTC/USD. Some of them, back in 2012 and such, look different. They tank with red dragons to the pre-bubble prices. That's at the back of my mind sometimes when i look at the long-term bubble patterns.

That said, I think crypto is here to stay, that the network effect is, well, in effect, and i think BTC is the most famous "brand name" in crypto.

So then I am thinking, what could possibly replace BTC ?

In terms of code quality, some of the best "open source ish" code comes from private corporations like Google sponsoring development for part of the code base (for example, Android based on Linux). It is just that:

1. a "privately owned source code" or even just "closed source code" wouldn't be trusted by crypto experts, and the opinions of crypto experts are starting to matter.

2. any coin that tries to profit from a major improvement... well, that part can be added to the Bitcoin source code (as long as they don't change the nature of the blockchain)

So yeah something better might come along and take over but, it is definitely not here yet, and hopefully we will be able to see it coming. No, i isn't embedding text in the blockchain, it isn't auto-mixing, it isn't Scrypt (+variants like lite, doge, ultra), it isn't primecoin, and it isn't mastercoin. They are only sidekicks. There will continue to be GPU-mined sidekick coins, and while we can make money on speculation in them, they will not take over the "dedicated hardware" mining market for BTC.

Anything that could threaten BTC's market position would have to have some revolutionary difference.

----

Anyway I think the red dragons will end, possibly with a spectacular event followed by relative stability and a single altcoin bubble followed by a long altcoin tank until the formation of the next bubble. Why? Because that's what happened in April 2013<->Nov 2014. That's all i got, the rest is guesstimation based on market indicators etc etc, like 5/11 Moving Averages on 1h candles of USD/BTC and USD/LTC. And others.

The only thing that lets me make guesses about movement in LTC/BTC is;

When BTC was in the same phase of the bubble->burst->dragons->tank->low->bubble thing, LTC/BTC behaved a certain way at certain times. Such an even right now (within 2 weeks) seems likely.

TL;DR all i got is "guess what will happen nov2013->July2014, based on what happened April2013->Nov2013"

Originally Posted by Satoshi

Reply With Quote

Reply With Quote

Connect With Us