Central bank easing policies will undoubtedly debase fiat currency values, subsequently creating a long-term tailwind for precious metal prices. This has been my central thesis and is the primary basis for being bullish on silver in 2013. Beyond central bank policies creating tailwinds for precious metals, the fiscal cliff deal that occurred yesterday does little to nothing in solving the debt crisis in the United States. Expanding debt levels in the United States, combined with the easy money supply globally, is a tailwind for precious metals because many investors trade precious metals as competing currencies against the dollar. To hedge against inflation that will eventually occur, many investors and nations seek financial protection in the precious metals, which in turn, will increased demand.

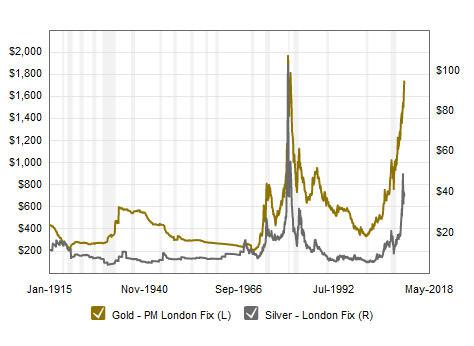

An interesting consideration is that there is currently more gold available to retail investors than there is silver. This means that the price of silver is more vulnerable to significant increases should current demand levels rise. It is one reason I believe silver could outperform gold. Another reason I believe silver could outperform gold in the coming years is the historical ratio of gold to silver prices, as shown in Figure 1. This ratio was historically 16:1; however, the current price ratio is 55:1. In order for the ratio to return to historical levels, silver must hold its price while gold drops significantly to around $500 an ounce, or silver must appreciate at a faster rate than gold in the coming years. Based on the historic ratio, silver is theoretically worth about $105 an ounce, representing an approximate 245% premium to current prices.

Figure 1. Price History of Gold and Silver in the Last 100 Years

Read the rest:

http://seekingalpha.com/article/1094...nsider-in-2013

Site Information

About Us

- RonPaulForums.com is an independent grassroots outfit not officially connected to Ron Paul but dedicated to his mission. For more information see our Mission Statement.

Reply With Quote

Reply With Quote

Connect With Us