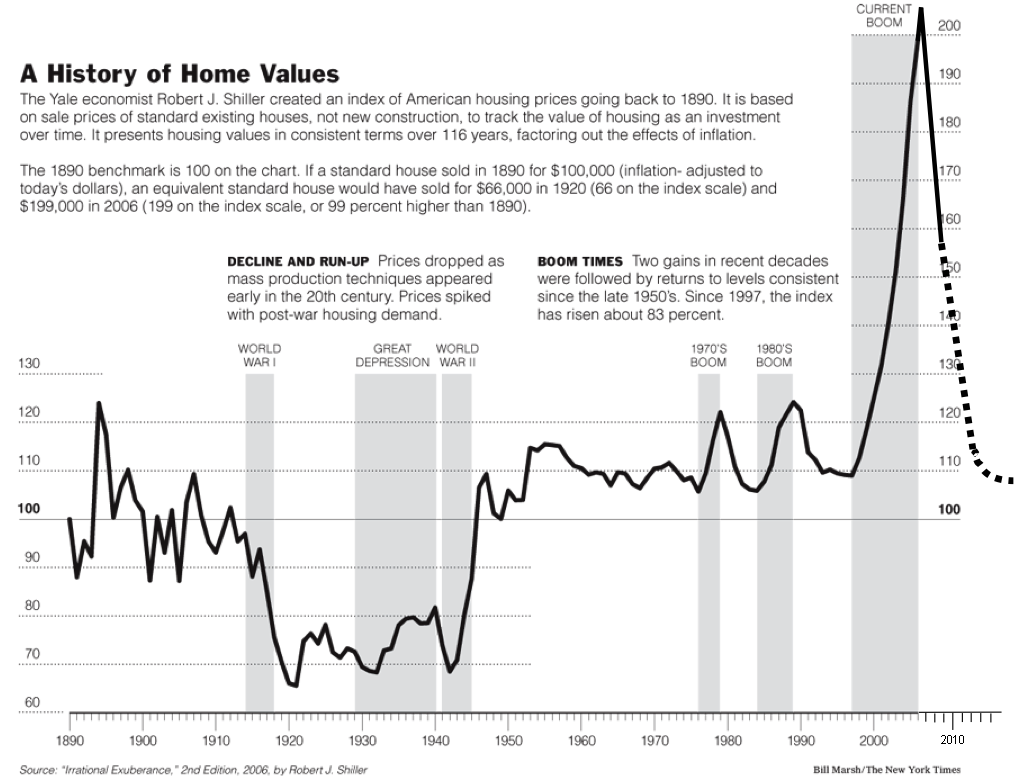

What is everyone's opinion of the housing market? Looking at the CPI vs housing market graphs it seems like the market prices have nearly returned to where they should be. I know the housing market is being propped up by government incentives currently, but realistically where do you think home prices will be in 2,5,10 years from now? (real terms, not nominal)

Thoughts?

Site Information

About Us

- RonPaulForums.com is an independent grassroots outfit not officially connected to Ron Paul but dedicated to his mission. For more information see our Mission Statement.

Reply With Quote

Reply With Quote

Connect With Us