This leveraged play on Gold offers huge potential for profits [or losses]

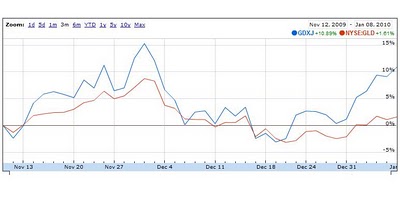

Since GDXJ started trading on Nov. 11, 2009, the ETF has outperformed the return of the gold bullion ETF GLD in impressive fashion.

GDXJ 10.9%

GLD 1.6%

As outlined in this background article GDXJ is comprised of smaller, more speculative gold miners and explorers, so the volatility is much more substantial the changes in the price of gold itself.

With Friday's jobs data sending the dollar lower and gold higher given the inverse relationship, while many feel there's been a gold bubble in formation for some time now, this trend may have legs. There was only 1 time in recent history when the gold-dollar correlation broke down and unless we have another complete global meltdown instantaneously, there's no reason to believe we'll see that anomaly repeat itself.

More on this ETF at VanEck:

http://www.vaneck.com/index.cfm?cat=...gdxj/googleppc

continue

http://seekingalpha.com/article/1818...by-wide-margin

Site Information

About Us

- RonPaulForums.com is an independent grassroots outfit not officially connected to Ron Paul but dedicated to his mission. For more information see our Mission Statement.

Reply With Quote

Reply With Quote

Connect With Us