Okay, I've seen enough chain letters discussing the cause of our economic woes, and they're all incorrect, so I figured it was time to write one that addressed the real issues. I've written this in plain English and have taken out any technical mumbo-jumbo so people will be able to understand it clearly. So, even though I will be leaving out some details everything in this message will be fundamentally true.

Okay, if you want to understand the problem we have with money in this country, you're going to have to understand 3 things:

1. Who makes our money.

2. How money comes into existence.

3. Inflation is nothing but a tax.

Let's tackle the first part:

PART I - Who Makes Our Money?

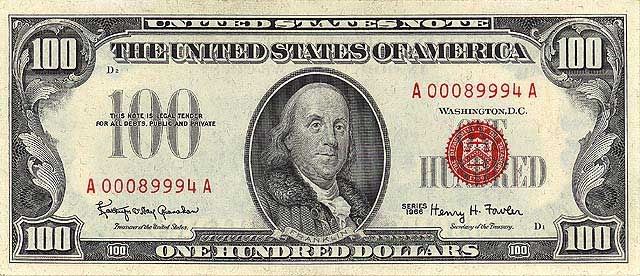

Here are 2 different $100 Bills. One has a red seal, the other a green seal.

Notice the top of this bill. It says United States Note. That means it is a note issued by the United States.

Now notice the top of this bill. It says Federal Reserve Note. That means it is a note issued by the Federal Reserve. It is NOT issued by the United States at all.

Well, who is the Federal Reserve? Aren't they part of the government you might ask? The answer to that is no. The Federal Reserve is a private company, just like Federal Express. And it is no more federal than Federal Express is.

Now both of these $100 Bills cost 4 cents to produce. In the old days the govt would simply print up a red seal $100 United States Note for 4 cents and spend the money on something it wanted. Not anymore. Today, the Federal Reserve gets to produce the $100 Bill for 4 cents and then sells the $100 Federal Reserve Note to the US Government for $100 Face Amount.

That bears repeating. The Federal Reserve (a private company) gets to produce slips of paper for 4 cents ($100 Bills) and then sells those pieces of paper to the US Govt for $100 Face Amount.

Now since the government doesn't have any money of its own how does it buy these Federal Reserve Notes? It pays for them with debt: Treasury Bonds, Treasury Notes, & Treasury Bills. If you read the paper or listen to the nightly news you'll hear the media say things like "The Fed injected liquidity into the markets..." or "The Fed is buying government securities..." All this means is that the Federal Reserve is literally creating money out of thin air and then selling this money to our government for its face amount. This is the true source of our National debt, and this is the reason our debt never goes down.

If you read an economics book this will be covered under the term "Monetization of government debt."

Now some of you might be saying, "Why should I care about any of this?" I'll tell you why.

You know all that income tax that comes out of your paycheck every week? Well your money is paying for this. Your income tax dollars do not pay for things like you think. The personal income tax does not pay for the military, roads, schools, or anything like that. It simply pays for the federal reserve notes with the green seal. In fact both the income tax and Federal Reserve were created in the same year - 1913. The income tax was created to finance the federal reserve.

Okay, pretty crazy right? Why in the world would our government pay a private bank for money, and then tax it's own citizens to pay for it, when we could just issue the money ourself practically for free? There is a reason, and we'll touch on it later. Right now we're going to explain the next part.

PART II - How Money Comes Into Existence

This part explains why we have booms and busts in the economy.

We now know that the government buys it's money from the private company called the Federal Reserve. And we know that the government pays for the money by issuing government debt. Because of this, the government doesn't even own it's own money, it only rents it.

(A $100 United States Note issued in 1966 only costs America 4 cents. While a $100 Federal Reserve Note issued in 1966 costs America $100 + $5 a year in interest for a total of $315.00)

When the government buys one dollar from the federal reserve

The government automatically owes that dollar PLUS 5 cents in interest.

+

The problem with this is that although the dollar is created, the extra 5 cents in interest is NOT created. This means there is not enough money in the economy for the government to pay back it's debt. After awhile it's not even possible for the government to pay the interest on it's debt unless the money supply is increased.

So out of necessity, the federal reserve & government will start a program of expanding the supply of money. The federal reserve will create more money to push down interest rates and the government will take on more debt to buy more of this money.

This causes malinvestment, which means:

People are encouraged to make wrong decisions because of false signals they are receiving from the marketplace. Businesses will tend to over expand when they shouldn't and over produce certain goods. (build too many houses for example.) Consumers will feel richer and so will wind up buying more cars, homes, etc. when they really cannot afford to.

This is where programs like the Community Reinvestment Act come into play as well as agencies like Fannie Mae, Freddie Mac, etc. Anything that encourages expansion of the money supply (like people borrowing to buy homes) will be done, and it doesn't matter whether the Republicans or Democrats are in power. They know they need to keep the supply of money growing. If they don't then this whole unstable system comes crashing down.

But since this system of money IS unstable it has to come crashing down anyway: Eventually the areas in which this money is put will form a "Bubble". It might be a Stock Market bubble or a real estate bubble, just to name a few. Eventually these bubbles will burst because they have been artificially created and are unsustainable. Inflationary booms are always followed by deflationary busts as a normal cleansing mechanism of the marketplace.

Now while this bubble is happening, the government can step in through taxation and confiscation and grab enough dollars to pay for the interest on its debt. (Income Tax). When the stock market bubble burst, they replaced it with an even bigger real estate bubble. Now that the real estate bubble is bursting they are trying to replace it with an even bigger "bond market/dollar bubble". The dollar bubble being formed now IS inflation, and will result in prices going up for everything. But like all bubbles, the dollar bubble will eventually burst and when it does the value of the dollar will be destroyed.

PART III - Inflation is a Tax (And that's all it is)

Okay, so far we have talked about two types of money, United States Notes and Federal Reserve Notes. But I have to be honest. Neither of those are actually money, they are only currency.

Here's the difference.

In 1950, you could buy 4 gallons of gasoline for ONE DOLLAR.

A paper dollar bought 4 gallons of gasoline.

A silver dollar bought 4 gallons of gasoline.

Now let's fast foward to 2009

A paper dollar will NOT buy you 4 gallons of gasoline.

You cant even buy ONE gallon of gasoline with it.

But a silver dollar will still buy you 4 gallons of gasoline.

(The silver content is always worth the price of 4 gallons of gasoline.)

Here's another example:

In this picture the price of oil is calculated from the year 2000 and priced in Dollars, Euros, and Gold. In dollars, the price of oil went up 350%, in euros it went up 200%, but in terms of gold it didn't go up in price at all.

Why do commodities like gasoline and oil not go up in price when priced in either gold or silver?

Answer: Gold & Silver are real money. They have intrinsic value. Gold and silver cannot be printed out of thin air the way paper dollars can, and so they retain their value.

When the federal reserve prints paper dollars and sells them to our government, the government is able to go out and buy whatever it wants at current market prices. But as that money circulates throughout the economy, the increase in paper dollars causes prices to rise. By the time the money gets to you and me,the price of a loaf of bread or a gallon of milk has already gone up. This is how inflation taxes us. The government who gets to use the newly made money first, steals our purchasing power through inflation. The end result is that we are taxed without even knowing it. But we all know we work harder and harder just to get the same things in life we had before. That is the invisible inflation tax in a nutshell. This tax affects middle class and poor people the most. And it is the reason we hear people say "The rich get richer, while the poor get poorer."

If we used gold or silver money, the gov't would be stopped from stealing our purchasing power through inflation.

Why don't we use gold and silver for money anymore? We're supposed to. It's the law.

The United States Constitution: Article I, Section 10.

No state shall enter into any treaty, alliance, or confederation; grant letters of marque and reprisal; coin money; emit bills of credit; make anything but gold and silver coin a tender in payment of debts; pass any bill of attainder, ex post facto law, or law impairing the obligation of contracts, or grant any title of nobility.

The founding fathers experienced massive hyperinflation during the Revolutionary War where the only way the country had to raise revenue was by printing paper money. Imagine having a pickup truck filled with paper money, scarcely being able to buy enough groceries to fill up your truck. It's happened before in America.

"A wagon load of money will scarcely purchase a wagon load of provisions". - George Washington, 1779.

Now this doesn't mean we have to walk around with bags of gold and silver. We can still use paper money, checks, debit cards, and electronic banking that is backed by silver and gold.

Let's take a look at how our $100 Bill is supposed to look. Unlike "Notes" which are not real money, "Certificates" are indeed real money because they are redeemable for the actual gold or silver at any time.

(IMAGES OF MONEY OMITTED BECAUSE OF FORUM SOFTWARE RESTRICTIONS)

PART IV - Why Does Our Government Do This?

Earlier, I told you I would explain why the government does this. And the answer is because it makes it easier for politicians to get re-elected.

Under our Constitution and a sound money system like a gold standard, the government would have to tax the citizens with what's called a direct tax.

Let's say the government wants to spend money on some programs and it's going to cost $300 Billion more than they are going to take in, in revenue. That means they are going to run a deficit of $300 Billion. With roughly 300 million citizens in America that results in a cost of $1,000 per man, woman and child. So now you get a knock on your door from a tax collector and are told that your family of 4 will have to immediately pay the government $4,000 in a direct tax so the government can spend money on these programs. What would you do? You would call up your congressman and bitch. You would tell him that if he doesn't fix the problem he will be out of a job.

You would take an active role in politics, and that's the last thing politicians want. They just want to get re-elected without all the hassle. So instead of taxing you honestly, they purchase money from the federal reserve, make our national debt go up, and devalue our money through inflation. And since the effects of inflation are delayed anywhere from between 6 months to 2 years, by the time gasoline or food prices go up, it can be blamed on war, greedy arabs, or bad weather, and the politician [and federal reserve] can escape the blame, even though they are the ones responsible. So the next time you hear that oil prices are higher because of a hurricane; remember it's not true.

PART V - How Do We Fix The Economy?

We got into this mess because we over spent, over borrowed, and over consumed.

So we need to do the opposite, which is save our money, pay back debt, and not consume as much.

But wait, I hear some of you say consumption is good for the economy. The nightly news tells us that the American economy is 2/3 driven by consumer spending. However, that is just another fallacy.

Production is the true measure of an economy not consumption. Anybody can eat an ear of corn, but before you can eat the corn, somebody had to grow it. Anybody can buy a new pair of jeans, but before you can buy them, somebody had to make the jeans. Somebody always has to produce before some other person can consume. And saving and spending work the same way. You have to earn and save your money before you can buy things. Here are two "fancy" economic terms and my common sense definitions for each. You should make sure you understand these because you will hear them more as the economy worsens:

Keynesian Economics: Economic theory that basically says, "Spend all the money you have. When you run out of money, borrow all you can and spend that too. When nobody will loan you anymore money, just print the money and keep spending." This is the policy our government follows. The gov't spent all our money, borrowed all we can from other countries, so now the final resort is printing even more money (and paying the federal reserve even more)

Austrian Economics: Economic theory that basically says, "If you want to buy something, make sure you have the money first. If you don't have the money then save up your money, and when you have enough, buy what you want. Pay your credit card balances in full every month and only go into debt if it's an emergency.

The Solution:

We need to let the free market function. Let the depression happen. If we let it happen, it will be over in about a year. If we drag it out with spending plan after spending plan the depression will last for 10 years or more. [Everybody has heard of the depression of 1929, but most people never hear about the depression of 1920-1921, which was actually worse. The difference was, in 1920-1921 the government didn't intervene with spending programs. Failed companies were allowed to go bankrupt, and bad debt was eliminated. After a year, the economy took off. The depression of 1929 was met with one government stimulus plan after another. The depression didn't end until after WWII, in 1946.]

Not only do we, as Americans need to cut back, but we need to produce goods and export them to other countries. We need to produce goods in America again. We need to promote jobs here and stop the outsourcing of American jobs overseas.

But in order to do this we need to decrease the size of government and increase personal liberty. We need to completely eradicate the Federal Reserve and Income Tax, and cut government spending by over $1.3 trillion a year. (which is how much the government collects each year from the personal and corporate income taxes). Basically, if we just follow the United States Constitution we can fix our problems.

Imagine the trillion dollars collected each year from the personal income tax no longer in the hands of the government but in everybodys' hands. That's a trillion dollars more people will have and they will spend their money alot more wisely than government does. Most of the time when government spends money it goes for wasteful programs and everytime the government wants to bailout somebody they wind up just bailing out their buddies.

Imagine with no more corporate income tax, how many companies would be coming back to America to open up shop here again. There would be so many companies coming here to open up shop and creating jobs, we would probably need illegal aliens to work them.

We need to bring back personal Liberty. That can be best summed up as you should have the right to keep 100% of the fruit of your labors (no income tax) and spend your money anyway you want. After all, it's your money. But with Liberty comes responsibility. If you get a paycheck on Friday and spend it all foolishly on Saturday, you can't run to the government because you have no money for food for the rest of the week. You instead will have to turn to your family, friends, and religious leaders or charity to help you. Eventually, you will learn to be responsible. In turn society benefits because the more responsible and productive our people are the better off the country will be. And as an added bonus there will be less idiots out there trying to sue McDonalds for making them fat or burning them with "Hot" coffee.

Further Reading, References, & Links

"The Creature From Jekyll Island" by G. Edward Griffin. You can download a complete audio mp3 of this book at the link: http://www.spielbauer.com/JekyllDownload.htm, burn it on a CD and after 1 hour you will know everything about the federal reserve that the government doesn't want you to know.

"Money, Banking, and the Federal Reserve" - 42 minute video. Complete history of money and banking. The first 7 minutes or so is reminscient of a high school educational video, but after that it gets very interesting. Watch it here:http://www.youtube.com/watch?v=iYZM58dulPE

Learn more about "Austrian Economics" at the Ludwig Von Mises Institute. Plenty of free mp3 downloads from various economists at http://www.mises.org

You can also Google or YouTube people like: "Ron Paul", "Peter Schiff", and "Jim Rogers", to get an honest evaluation of the economy and how it relates to current events.

Tune into http://freedomwatchonfox.com/ every Wednesday at 2pm Eastern Time to watch Judge Andrew Napolitano's internet program "Freedom Watch" where he always has new guests who explain the real deal within our government.

And sometimes it helps to talk to somebody who already understands these things. If you ever have any questions feel free to visit http://www.ronpaulforums.com. Most people at the forums are familiar with all the facts in this email and can probably help you answer any questions you might have.

And don't forget to read the Constitution and Declaration of Independence every now and then to give yourself a refresher course on Liberty. If you've never read either, then there is no time like the present to start. You'll learn a lot from these truthful and wise documents.

Site Information

About Us

- RonPaulForums.com is an independent grassroots outfit not officially connected to Ron Paul but dedicated to his mission. For more information see our Mission Statement.

Reply With Quote

Reply With Quote

Connect With Us